Housing Benefit

If you are of working age and on a low income or out of work, you can make a claim for Universal Credit as your housing costs will be included in your Universal Credit award and they will not be covered by Housing Benefit.

You can only claim Housing Benefit if you are of:

- working age and live in specified accommodation (care, support and / or supervision provided)

- working age and live in temporary accommodation

- Pension Credit age

Information you may need during the online application

The application will ask you for details of certain documents as you progress. You may need some of the following so please have the information at hand.

- National Insurance number

- Earnings/Self employed earnings

- State benefits Pensions

- Bank/Building Society accounts

- All capital/savings

- Non-dependent’s income

- Tax credits

- Child care costs

Saving and submitting your Housing Benefit application

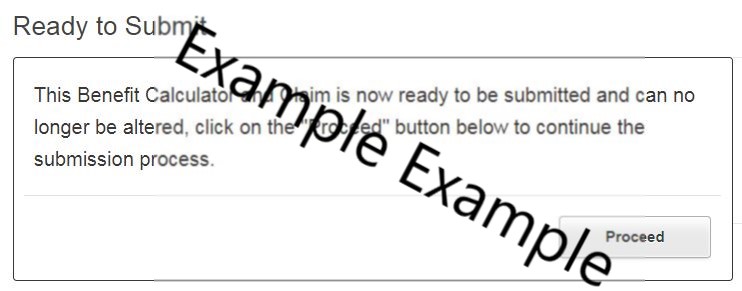

Please make sure when you make your application online and have filled in your details you click on the 'Proceed' button in the box at the bottom of the page.

Below is an image of the box to look out for when completing the form.

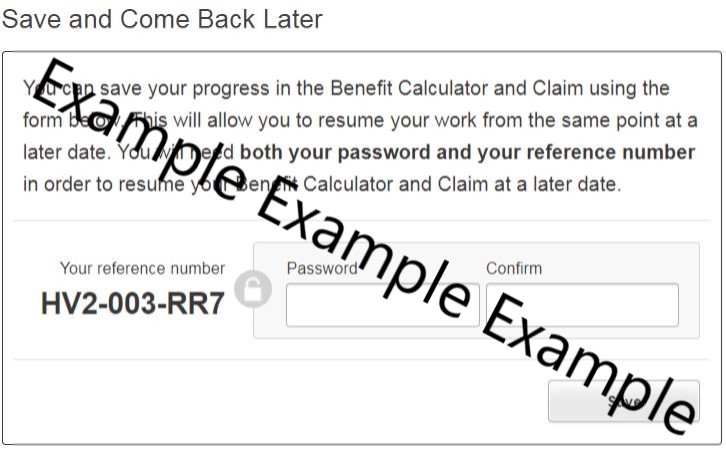

You can also save and come back to your application at any time. Just look out for the 'Save and Come Back Later' box, make a note of the reference number and create a password you can remember.

Below is an image of the box to look out for when completing the form.

None of the above apply to you?

If none of the above apply to you and you need help with your rent, you will need to claim Universal Credit.

Please note: If you are already in receipt of Universal Credit and are placed into temporary accommodation by Havering Housing Services, you must inform the DWP immediately as you will need to claim your housing costs through Housing Benefit. Please make your claim using the Housing Benefit link above.

Council Tax Support

For financial help with your Council Tax you must make a claim with the Local authority that you live in.

If you live in Havering and

- have a liability to pay Council Tax

- are aged over 18

- are working age and have less than £6,000 capital *

- are of pensionable age and have less than £16,000 capital *

- if you are single, of pensionable age (do not qualify for Council Tax Support) and have other adults on a low income living with you

(*except those in receipt of a qualifying state benefit)

Saving and submitting your Council Tax Support application

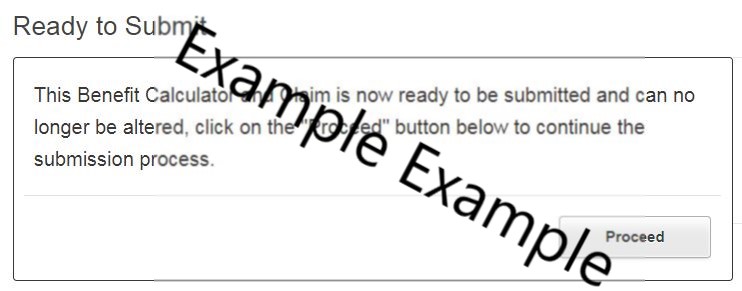

Please make sure when you make your application online and have filled in your details you click on the 'Proceed' button in the box at the bottom of the page.

Below is an image of the box to look out for when completing the form.

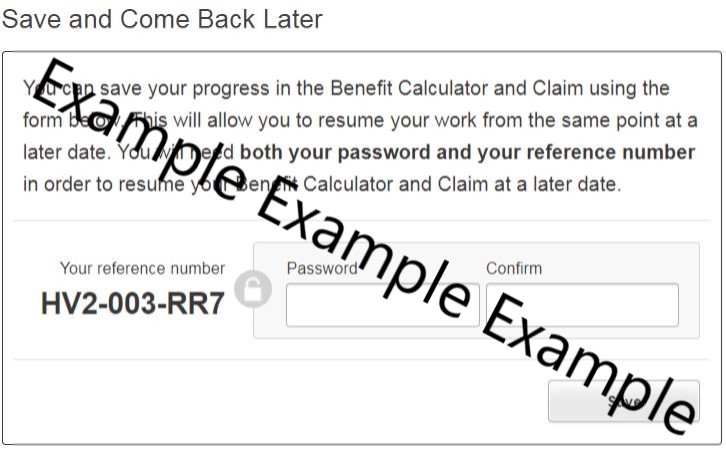

You can also save and come back to your application at any time. Just look out for the 'Save and Come Back Later' box, make a note of the reference number and create a password you can remember.

Below is an image of the box to look out for when completing the form.

How the amount of Council Tax support is calculated

The amount of Council Tax Support you get is based on your income and age.

If you are of pensionable age, Council Tax Support can be any amount up to 100 percent of your Council Tax liability.

Working age people with disabilities can have their Council Tax reduced by up to 80 percent.

For everyone else, Council Tax Support can be reduced by up to 75 percent.

For more information about the Council Tax Support Scheme, please see the Havering local Council Tax support scheme documents.

Backdated claim for housing benefit and Council Tax support

We may be able to backdate your housing benefit and Council Tax support if you can show that you have had good cause for not making your claim at an earlier date.

You can only make a backdating claim if you have an existing Housing Benefit claim or have made a new application for benefits.

Make a backdated claim for housing benefit and Council Tax support